DeepSeek Stock Market Disruption: Why It Matters in 2025

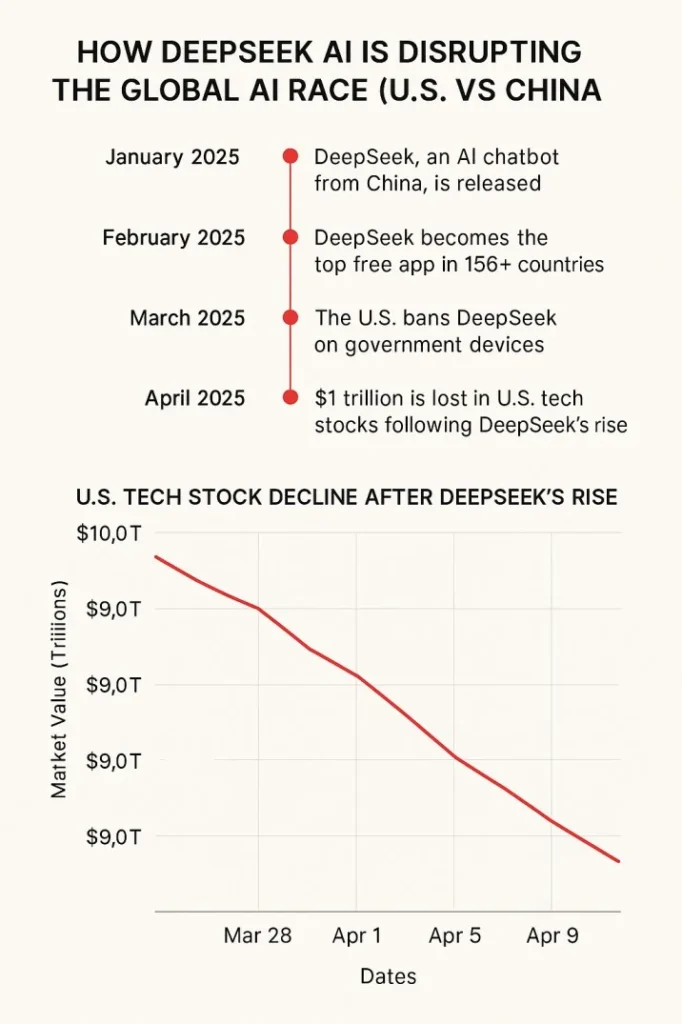

The DeepSeek stock market impact has quickly become one of the biggest tech-financial stories of 2025. DeepSeek AI, a Chinese open-source generative chatbot, has rapidly risen to challenge Western AI giants like ChatGPT and Gemini. Developed within China’s national tech strategy, DeepSeek is more than just an app—it’s a symbol of shifting global power in the AI space. Its launch triggered widespread market reactions, shaking investor confidence in established U.S. tech firms and sending shockwaves across Wall Street.

What Is DeepSeek AI and Why It Matters

DeepSeek AI is an open-source generative AI chatbot developed in China, gaining global attention for its ability to rival Western AI models like ChatGPT and Gemini. Developed as a cutting-edge alternative rooted in China’s technological ecosystem, DeepSeek reflects the nation’s increasing ambition to lead the global AI race. Its rapid evolution from a niche project to a global contender signifies a strategic shift in the East-West AI balance. In recent months, the DeepSeek stock market buzz has intensified as its rise disrupted investor confidence in major U.S. tech firms.

DeepSeek’s Global Success and Stock Market Shockwave

Within days of its release, DeepSeek topped AI app charts across Asia and began trending in Europe and North America. With over 10 million downloads in its first two weeks, the app shocked Silicon Valley investors. This success triggered a broad tech selloff in the U.S., with AI-heavy stocks like Nvidia, Microsoft, and Alphabet losing billions in market capitalization. Analysts dubbed this the “DeepSeek Shockwave,” cementing its role in the DeepSeek stock market disruption.

What Caused the U.S. Stock Selloff?

The stock dip was more than a reaction to another AI tool—it reflected deep concerns about:

- China’s sudden lead in open-source GenAI

- U.S. over-dependence on closed AI ecosystems

- Potential policy disruptions favoring open-source, decentralized models

Investors feared that DeepSeek’s low-cost, scalable AI model could undercut U.S. giants reliant on subscription-based, closed platforms.

DeepSeek and the U.S.-China AI Arms Race

DeepSeek’s emergence is widely considered a “Sputnik Moment” in AI geopolitics. It not only showcased China’s innovation capacity but also highlighted strategic AI priorities:

- U.S. focusing on monetization, patents, and corporate AI control

- China emphasizing open-source, nationalized innovation, and mass AI literacy

This divergence could reshape global AI development paths, regulatory frameworks, and military applications.

DeepSeek Stock Market: Why Investors Worldwide Are Watching Closely

The DeepSeek stock market buzz isn’t just about one company—it reflects a broader shift in how global investors view AI innovation. DeepSeek’s rapid rise has forced investors to reevaluate the strength and scalability of Chinese AI models. This trend has sparked interest in Chinese AI ETFs and tech stocks that might benefit from DeepSeek’s momentum.

Investor Insights:

- U.S. investors are tracking Chinese tech indices for DeepSeek exposure

- Global funds are adjusting AI-heavy portfolios

- Some traders consider DeepSeek’s emergence a leading indicator for AI market pivots

DeepSeek Stock Market Impact: What It Means for the Future of AI Investing

The DeepSeek stock market impact is being compared to landmark moments in tech history—like the rise of Tesla or the launch of the iPhone. It didn’t just affect a few stocks; it shifted global investor psychology. Nvidia’s record one-day market cap loss after DeepSeek’s breakout underscores the potential power of emerging AI platforms.

Long-Term Effects Include:

- Renewed debate over open-source vs. closed AI ecosystems

- Increased AI regulation and national security concerns

- A new wave of “AI sympathy plays” in Asian stock markets

Post-DeepSeek: Who Will Dominate the AI Market?

The aftermath of DeepSeek’s launch has analysts split:

- Winners: Open-source communities, China’s domestic AI scene, emerging markets seeking free AI access

- Losers: U.S. tech monopolies, premium-only AI tools, Western investors fearing state-supported competition

However, it’s also fueling innovation, with Western firms accelerating updates and partnerships to keep pace.

How to Buy DeepSeek Stock in 2025

Retail investors are eager to invest in DeepSeek’s success, but here’s what you need to know:

- DeepSeek is not currently a publicly traded company.

- However, you can invest in companies with exposure to DeepSeek (e.g., Chinese tech conglomerates, AI chipmakers, etc.)

- Stay updated on IPO rumors, as a listing could come via Hong Kong or Shanghai exchanges.

Is DeepSeek Publicly Traded?

No, DeepSeek is not publicly traded as of now. It’s part of a state-aligned tech initiative and may not follow the traditional IPO path. Keep an eye on affiliated companies or government-backed funds for DeepSeek stock market exposure.

DeepSeek vs. Nvidia: Who’s Ahead in AI?

- Nvidia: Dominates the AI chip market; key supplier to most major AI models.

- DeepSeek: Software-based disruptor; leverages open-source and rapid iteration.

While Nvidia powers AI, DeepSeek is reshaping how it’s deployed and accessed globally.

Rad More: Will DeepSeek Overtakes ChatGPT

DeepSeek Stock Price: What We Know So Far

While DeepSeek AI has not gone public, investor interest has surged globally. Although there’s no official DeepSeek stock price, speculation is high regarding its future valuation, especially with Chinese tech firms backing its development. Analysts estimate that if DeepSeek were listed today, its market cap could rival early valuations of OpenAI-backed startups.

Key Factors Driving Price Speculation:

- Anticipated IPO via the Shanghai or Hong Kong Exchange

- Government backing boosting confidence

- Rising downloads and global market traction

DeepSeek Stock Price Chart: Projections and Market Sentiment

Since DeepSeek isn’t publicly traded yet, no official DeepSeek stock price chart exists. However, industry experts have begun sharing projected charts based on comparable AI firms and current investment activity in China’s tech sector.

You may find estimated trend charts from financial analysts or YouTube creators focusing on:

- Potential IPO timelines

- Sympathetic stock movement in related companies

- Comparative valuation vs. U.S. AI firms like OpenAI, Anthropic, and Cohere

FAQ: DeepSeek Stock, Bans, and Investor Tips

Why did Nvidia’s stock drop after DeepSeek?

Investors feared reduced demand for proprietary AI tools and chips, anticipating an open-source shift.

Is DeepSeek banned in the U.S.?

Not officially, but several U.S.-aligned countries have issued warnings or restricted usage due to data and privacy concerns.

Can I invest in DeepSeek stock?

Directly? Not yet. Indirectly? Yes, via exposure to related Chinese tech firms or ETFs.

Conclusion

The DeepSeek stock market disruption is more than a financial event—it’s a geopolitical signal that AI dominance is no longer a one-sided race. As China pushes forward with open-source innovation, U.S. firms must evolve or risk falling behind. Investors, policymakers, and developers worldwide should keep a close eye on DeepSeek—not just as a tech marvel, but as a symbol of shifting global power in the AI era.